1.6: Solving the Consumer’s Problem

ECON 306 · Microeconomic Analysis · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microS20

microS20.classes.ryansafner.com

The Consumer's Problem: Review

- The consumer's constrained optimization problem is:

Choose: < a consumption bundle >

In order to maximize: < utility >

Subject to: < income and market prices >

The Consumer's Problem: Tools

We now have the tools to understand consumer choices:

Budget constraint: consumer's constraints of income and market prices

- How the .red[market] trades off between two goods

- Utility function: consumer's preferences to maximize

- How the .green[consumer] trades off between two goods

The Consumer's Problem: Verbally

- The consumer's constrained optimization problem:

choose a bundle of goods to maximize utility, subject to income and market prices

The Consumer's Problem: Mathematically

maxx,yu(x,y)

- This requires calculus to solve1. We will look at graphs instead!

1 See the mathematical appendix in today's class notes on how to solve it with calculus, and an example.

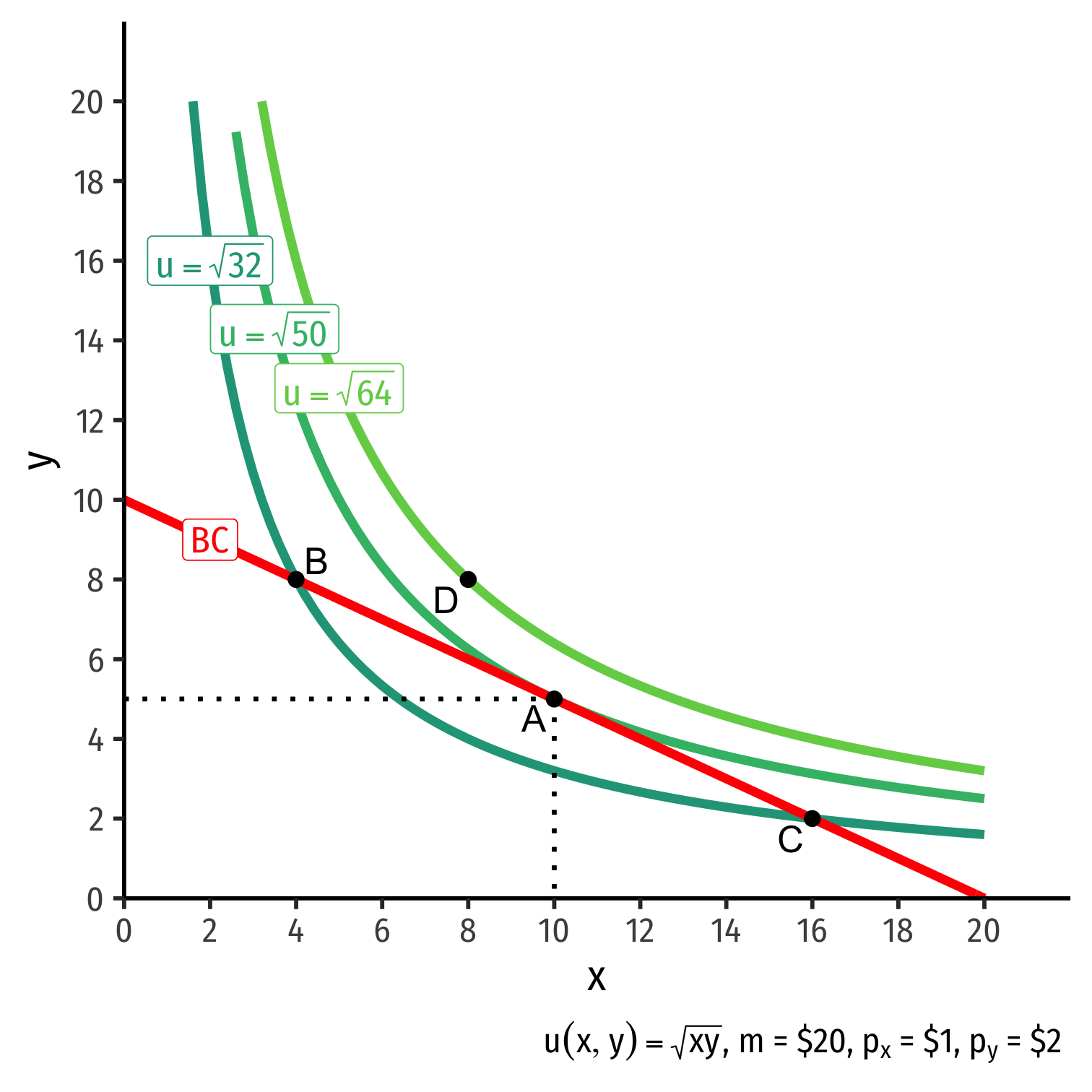

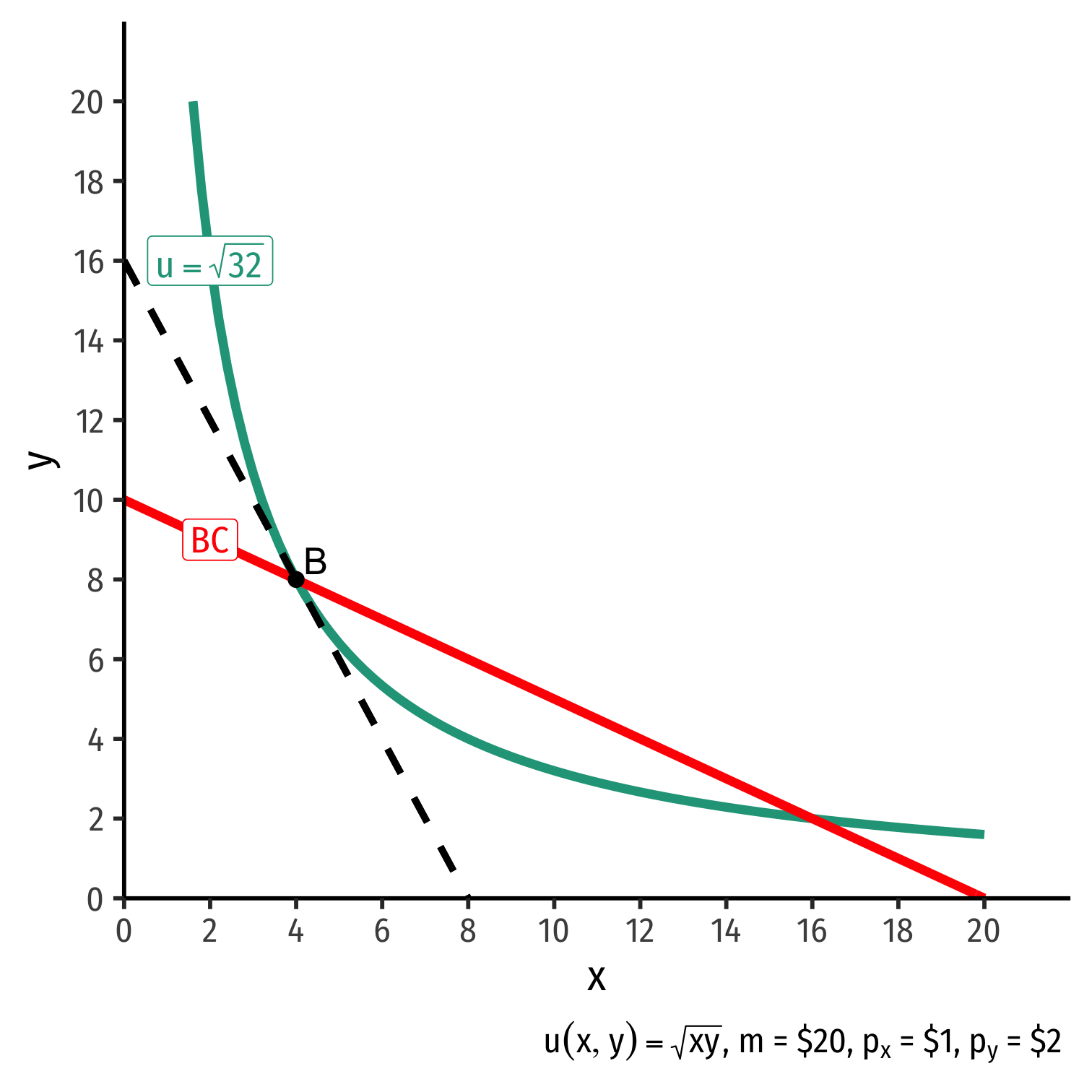

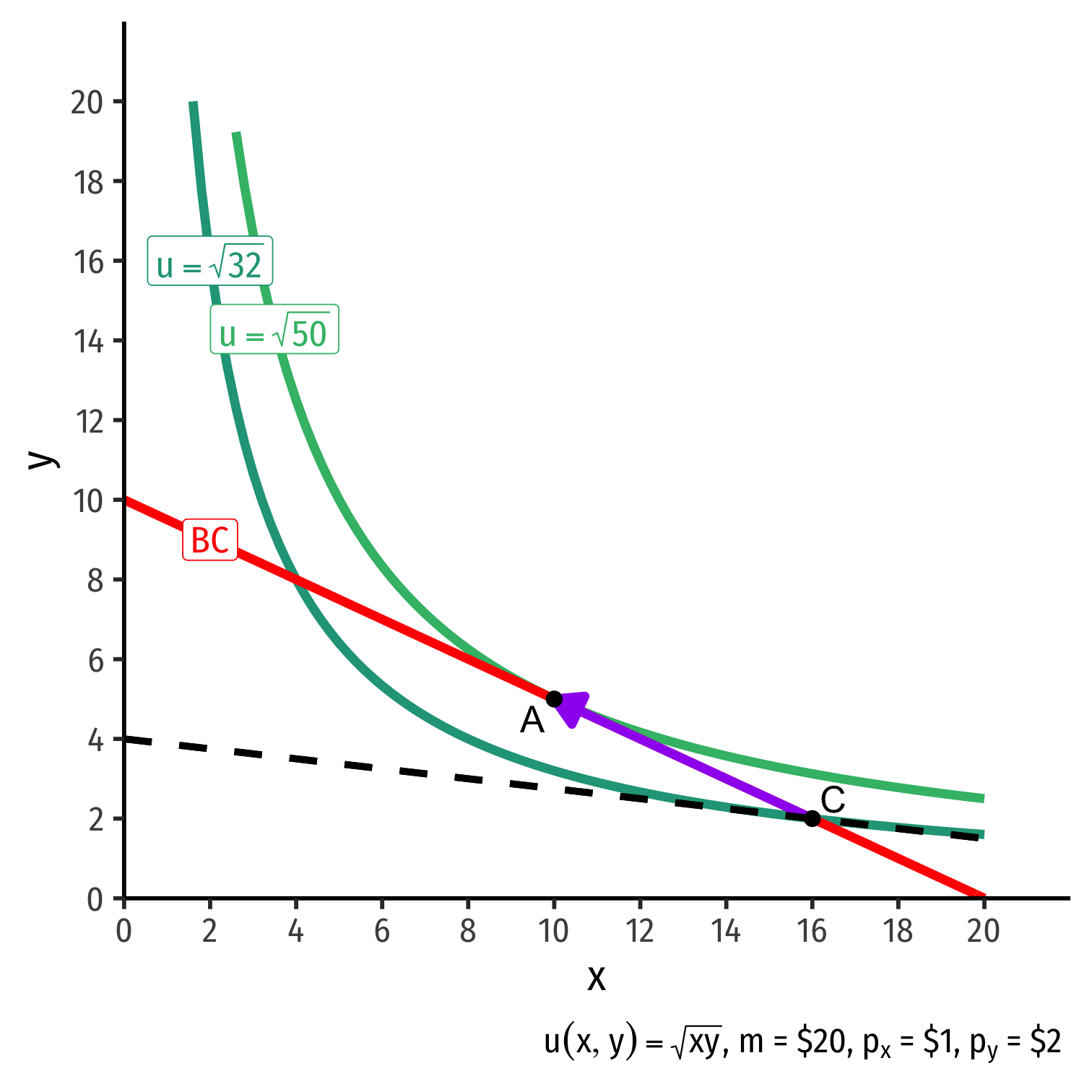

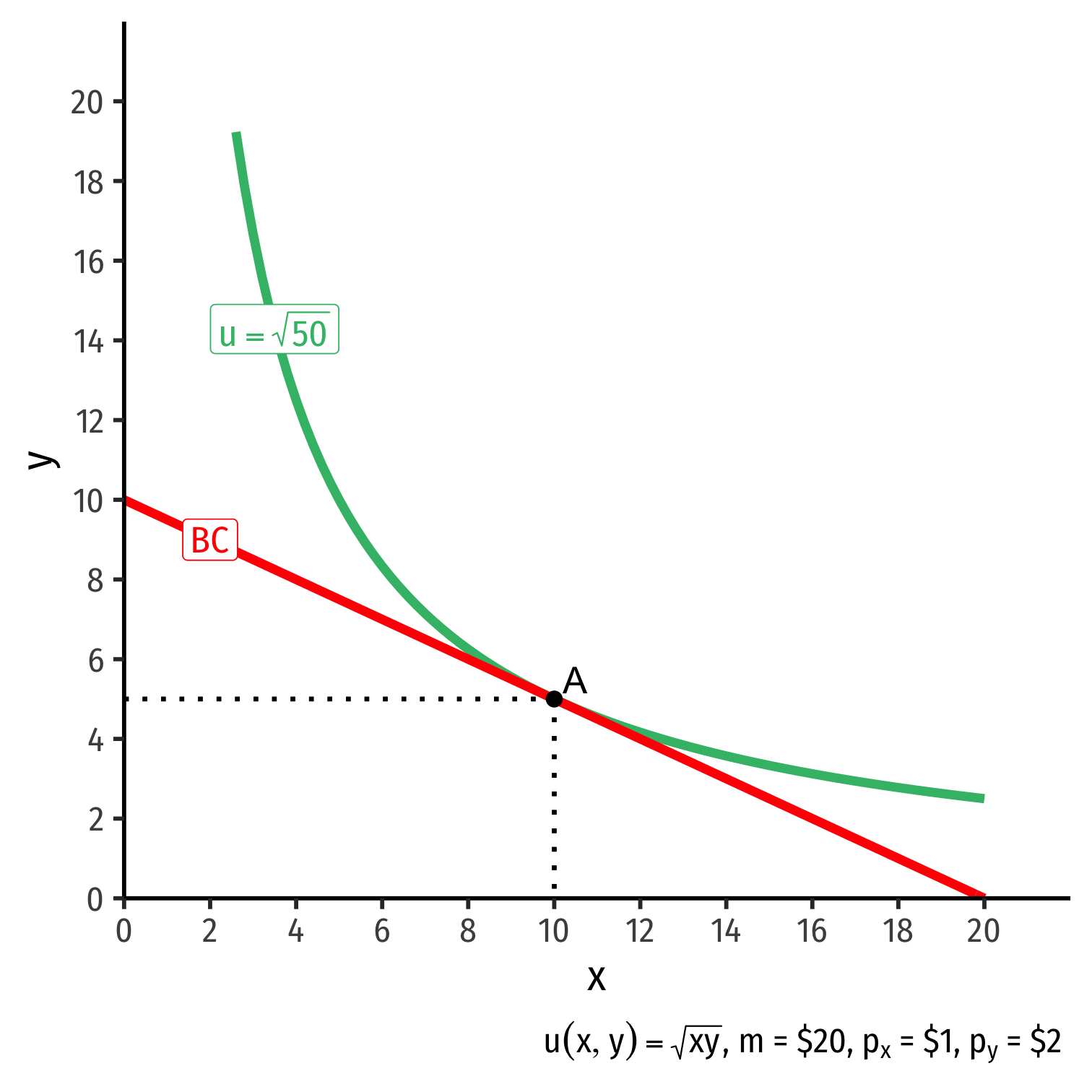

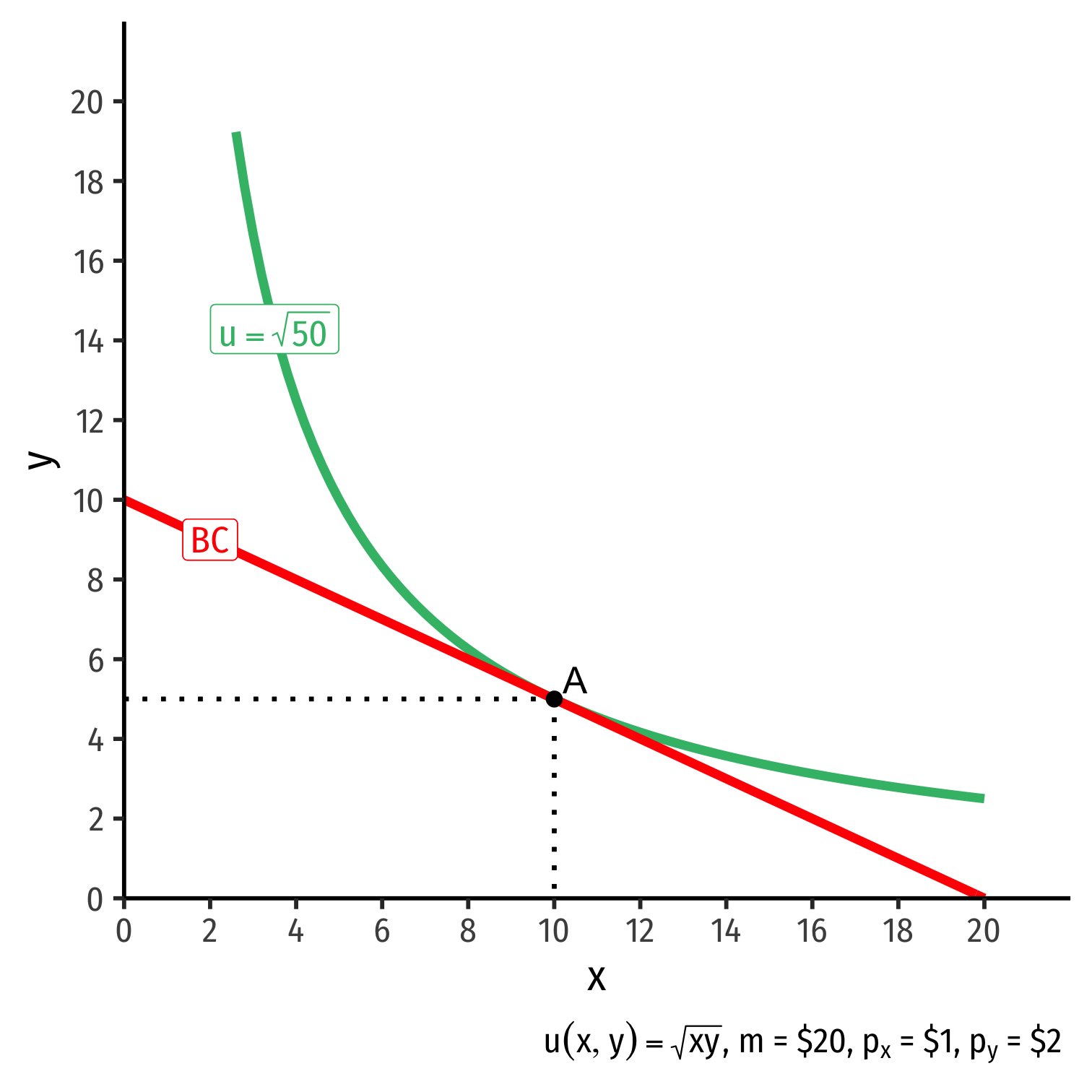

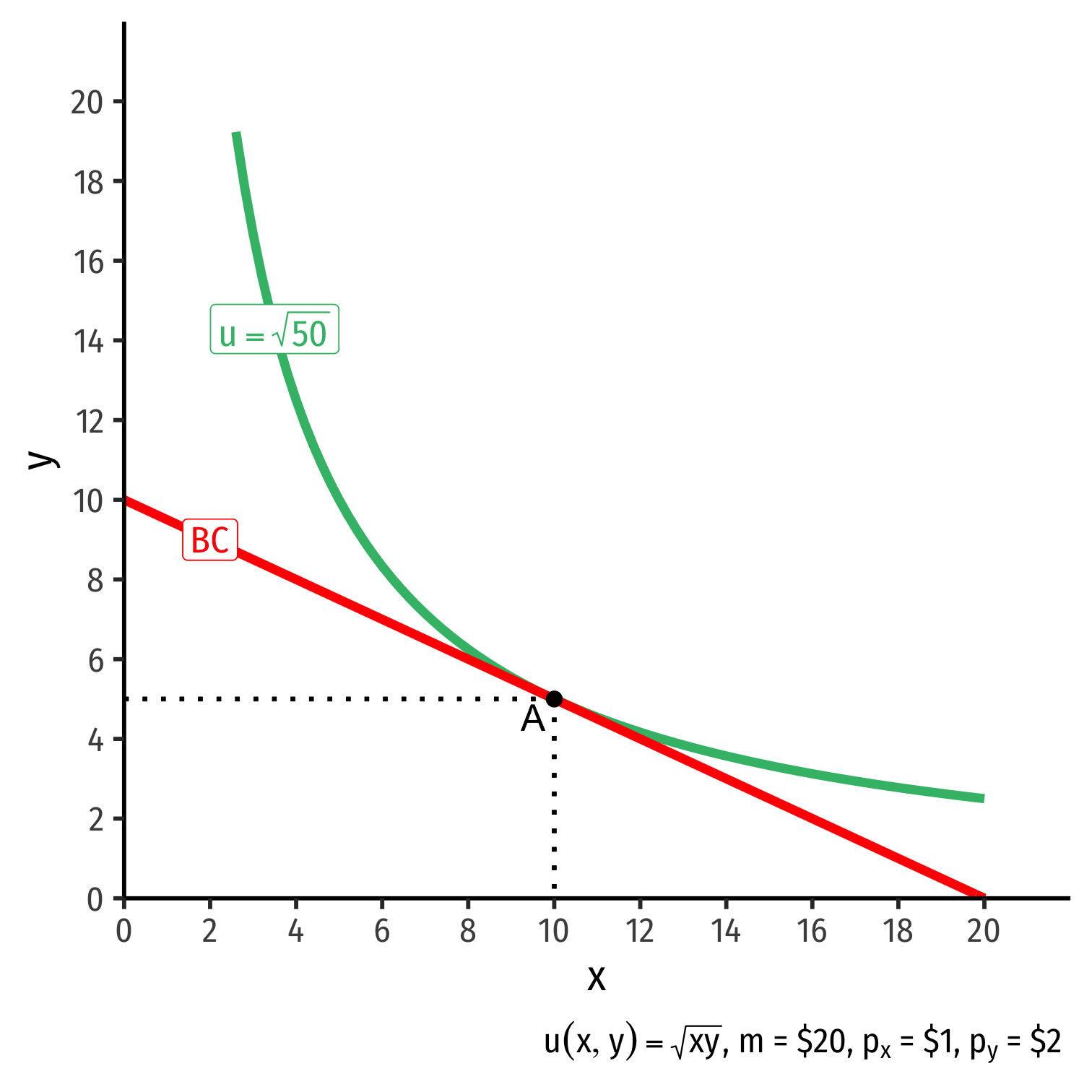

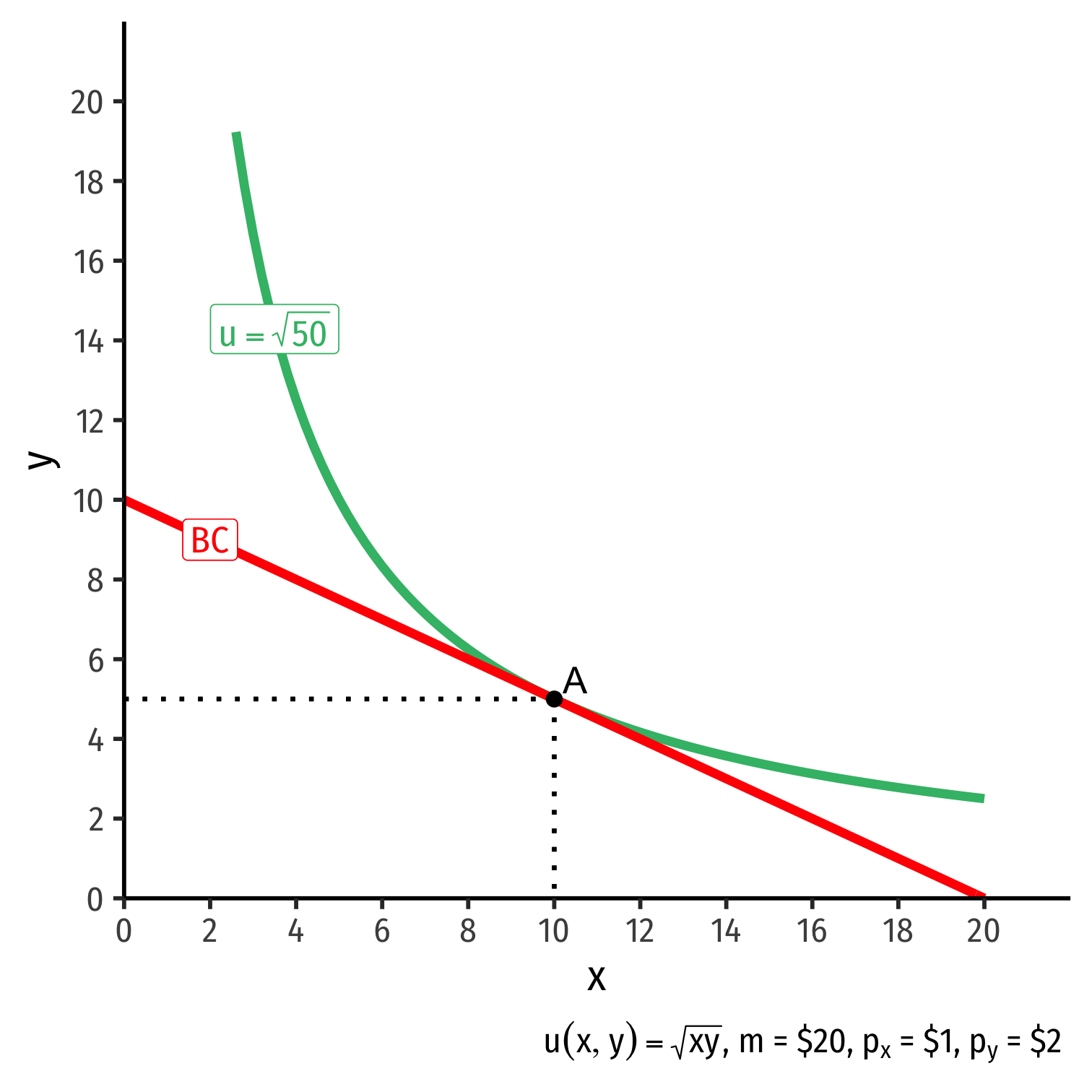

The Consumer's Optimum: Graphically

- Graphical solution: Highest indifference curve tangent to budget constraint

- Bundle A!

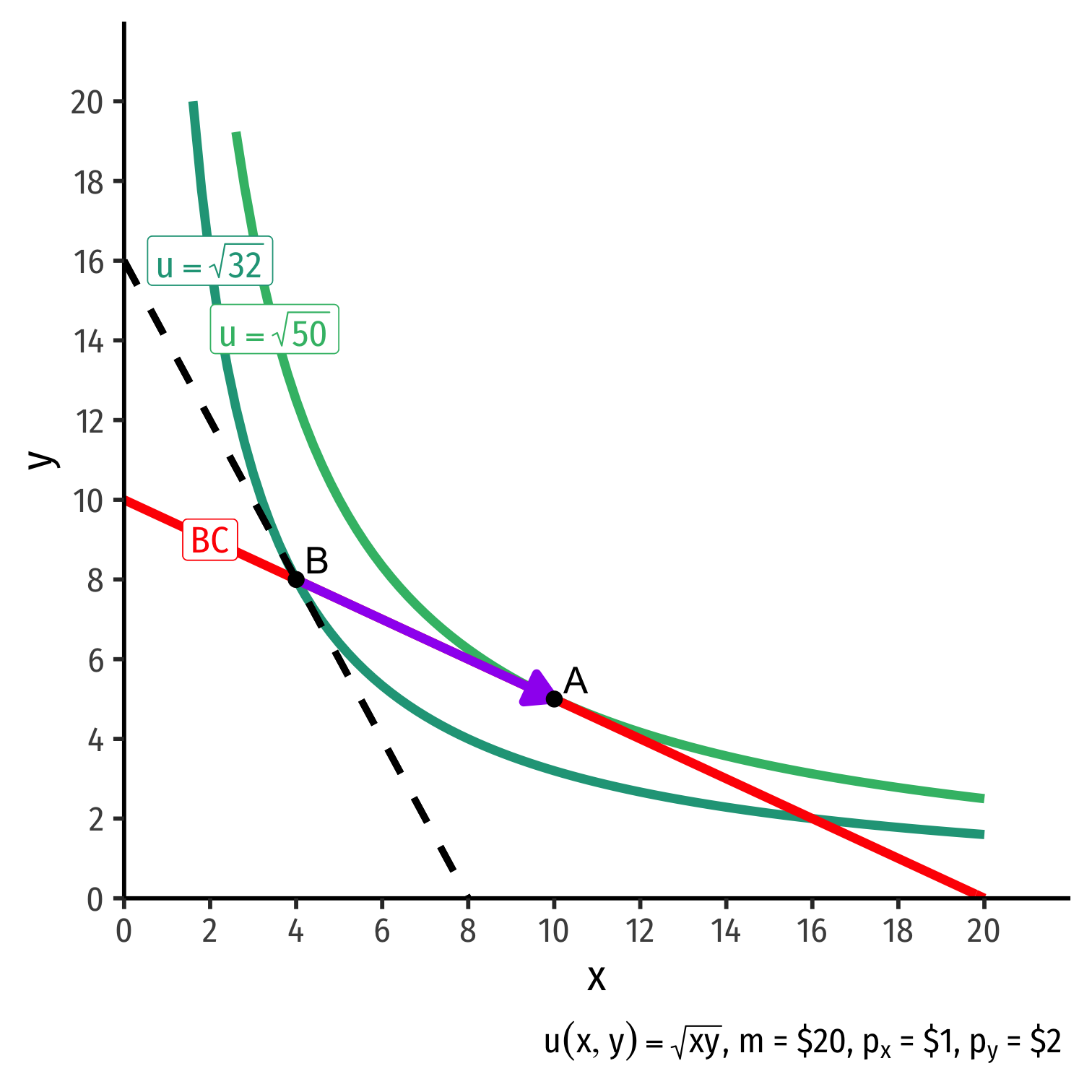

The Consumer's Optimum: Graphically

Graphical solution: Highest indifference curve tangent to budget constraint

- Bundle A!

B or C spend all income, but a better combination exists

- Averages ≻ extremes!

The Consumer's Optimum: Graphically

Graphical solution: Highest indifference curve tangent to budget constraint

- Bundle A!

B or C spend all income, but a better combination exists

- Averages ≻ extremes!

D is higher utility, but not affordable at current income & prices

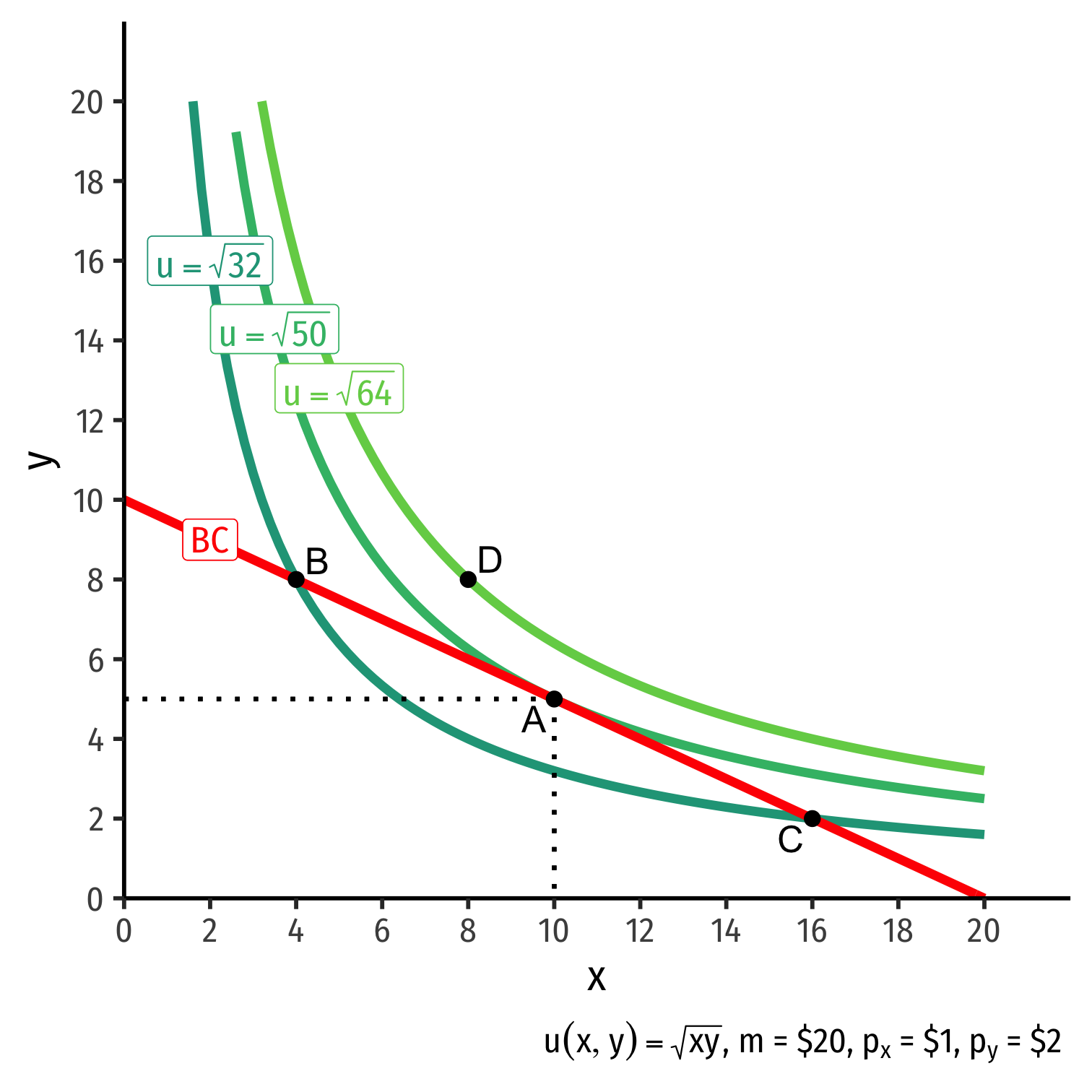

The Consumer's Optimum: Why Not B?

indiff. curve slope>budget constr. slope

The Consumer's Optimum: Why Not B?

indiff. curve slope>budget constr. slope|MRSx,y|>|pxpy||MUxMUy|>|pxpy||−2|>|−0.5|

Consumer would exchange at 2Y:1X

Market exchange rate is 0.5Y:1X

The Consumer's Optimum: Why Not B?

indiff. curve slope>budget constr. slope|MRSx,y|>|pxpy||MUxMUy|>|pxpy||−2|>|−0.5|

Consumer would exchange at 2Y:1X

Market exchange rate is 0.5Y:1X

Can spend less on y more on x and get more utility!

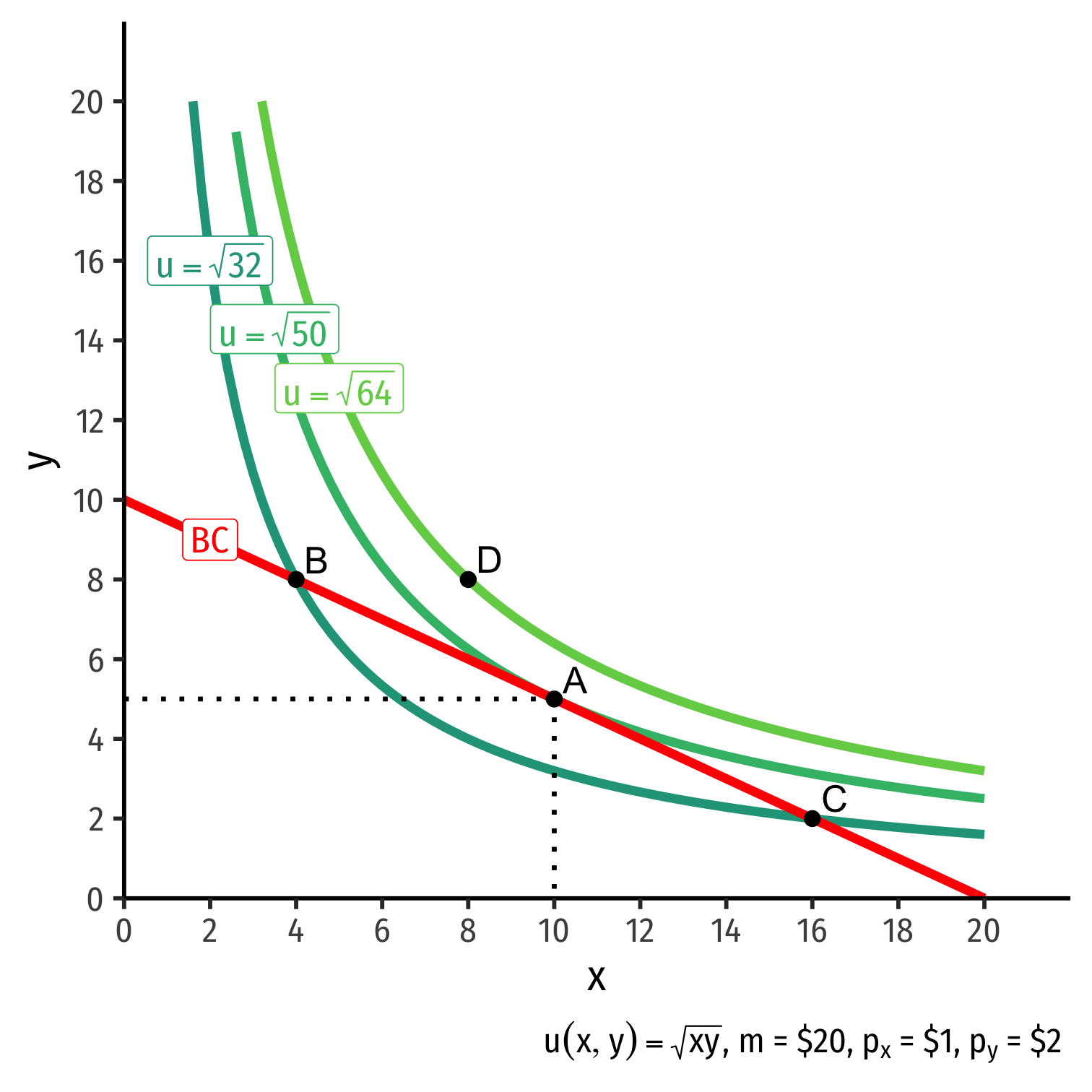

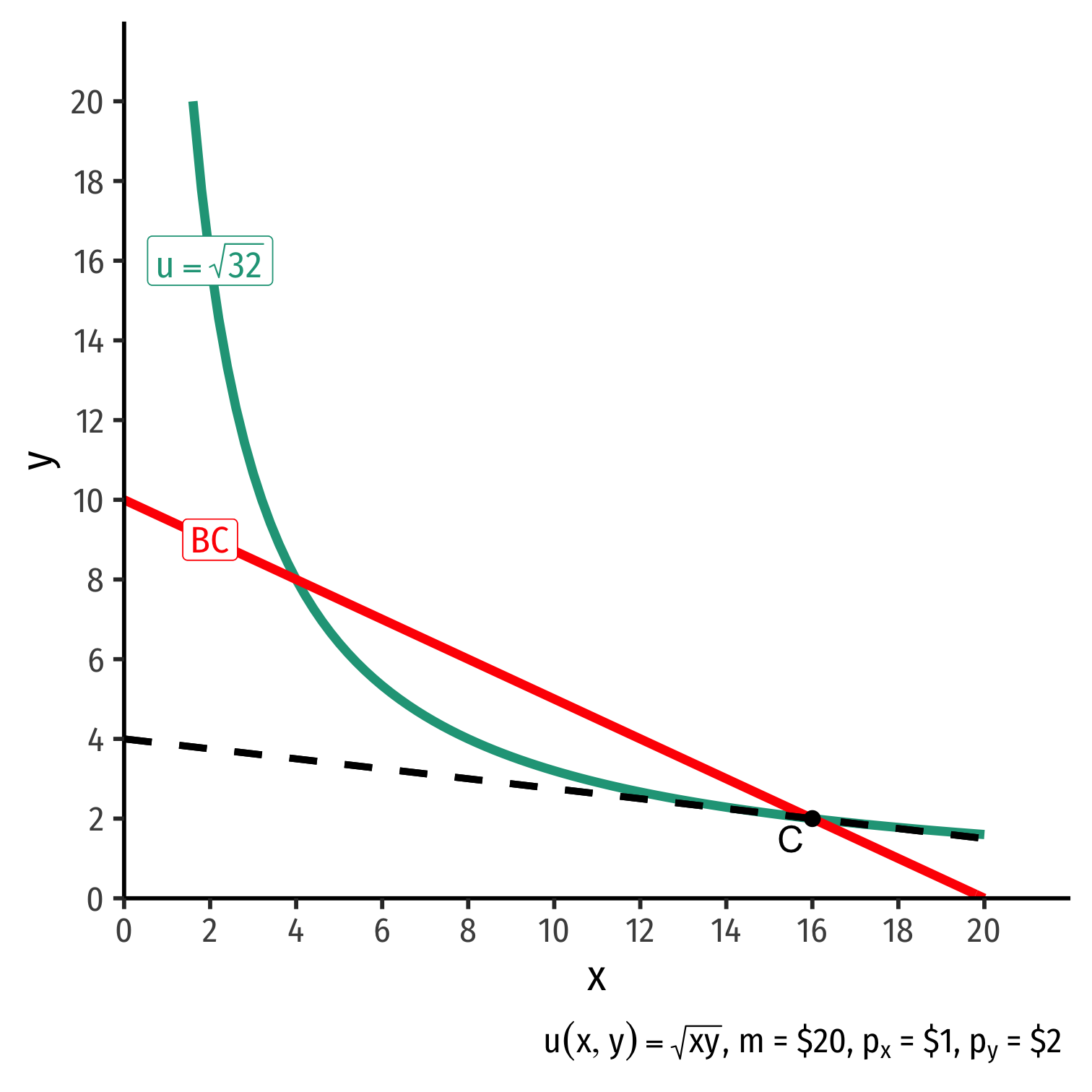

The Consumer's Optimum: Why Not C?

indiff. curve slope<budget constr. slope

The Consumer's Optimum: Why Not C?

indiff. curve slope<budget constr. slope|MRSx,y|<|pxpy||MUxMUy|<|pxpy||−0.125|<|−0.5|

Consumer would exchange at 0.125Y:1X

Market exchange rate is 0.5Y:1X

The Consumer's Optimum: Why Not C?

indiff. curve slope<budget constr. slope|MRSx,y|<|pxpy||MUxMUy|<|pxpy||−0.125|<|−0.5|

Consumer would exchange at 0.125Y:1X

Market exchange rate is 0.5Y:1X

Can spend less on x, more on y and get more utility!

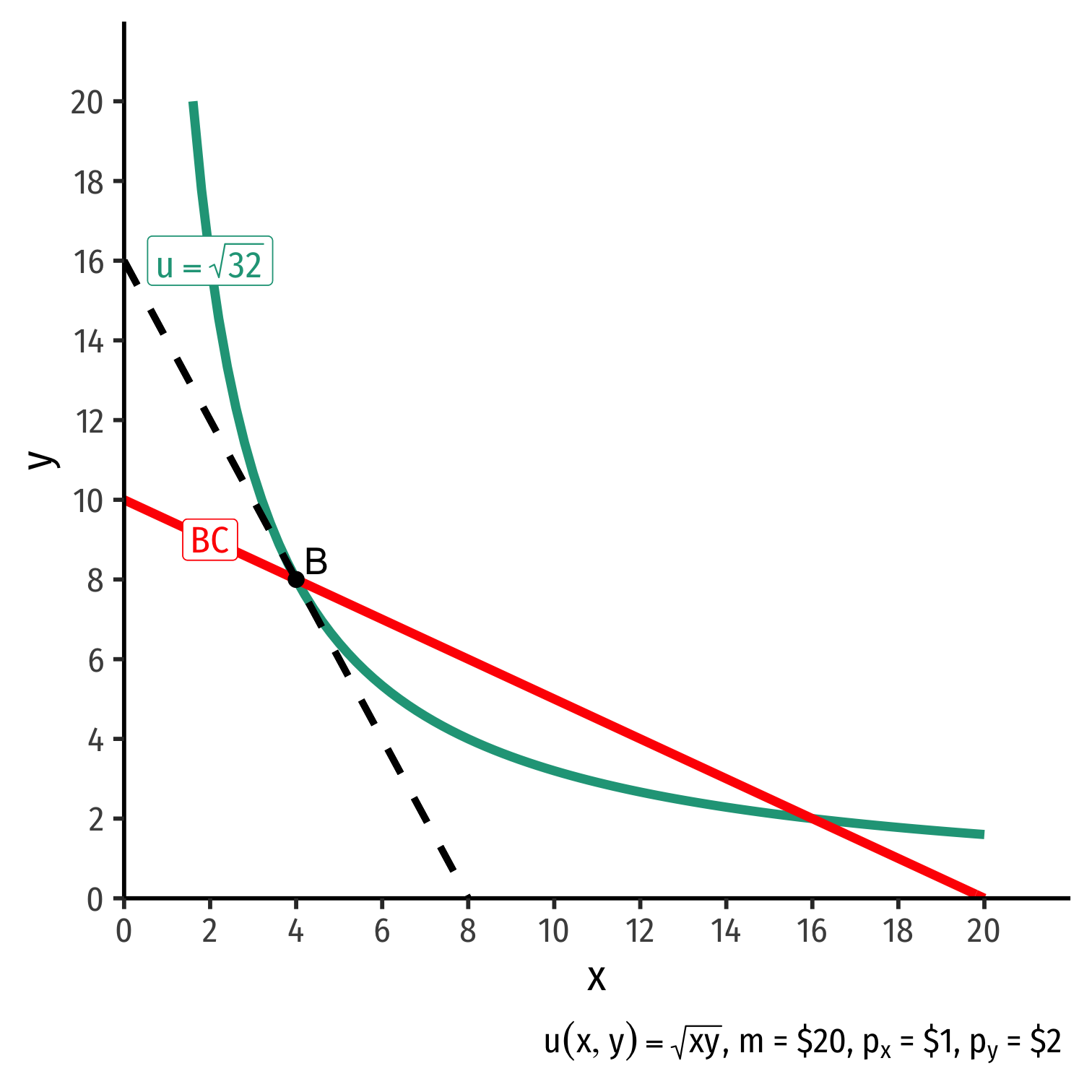

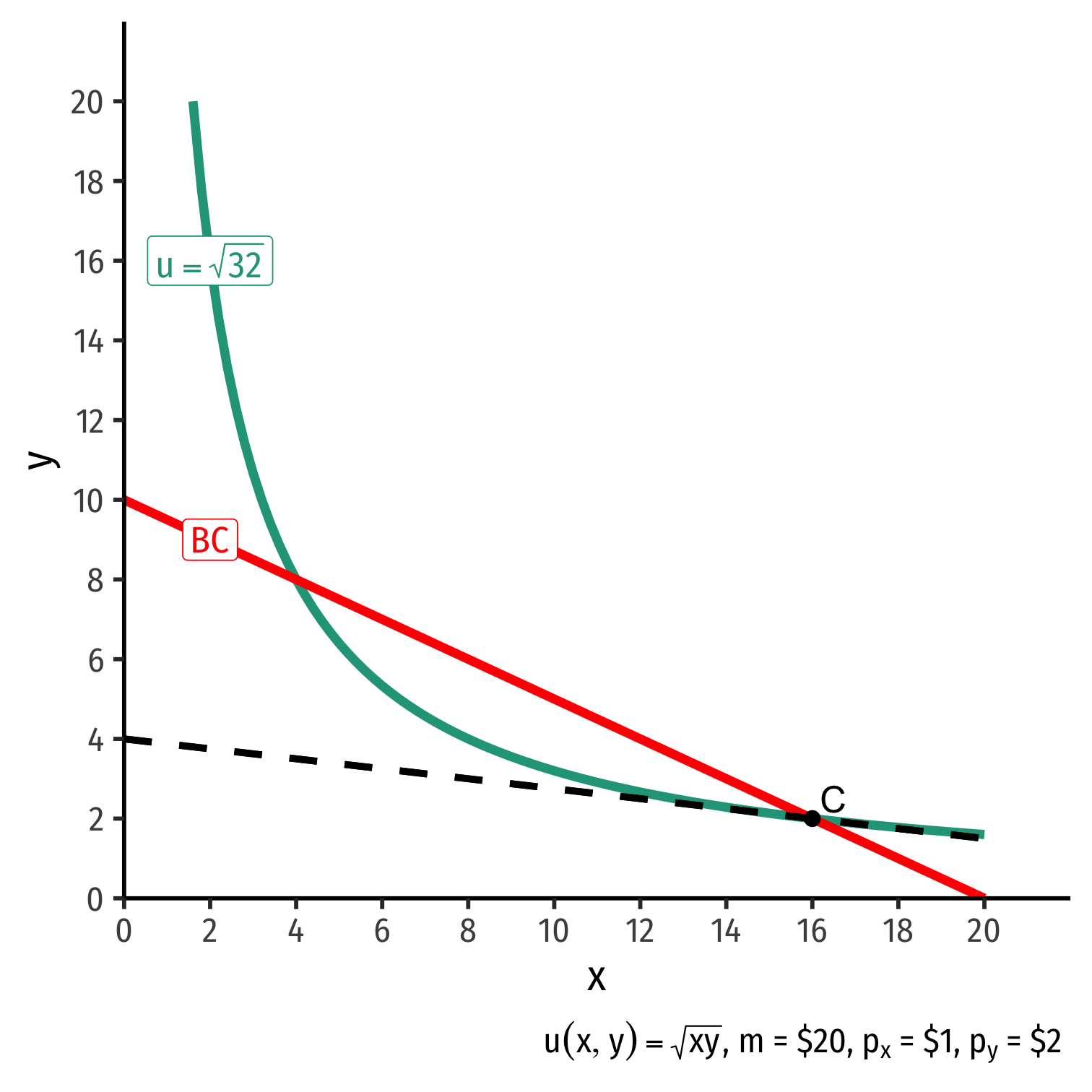

The Consumer's Optimum: Why A?

indiff. curve slope=budget constr. slope

The Consumer's Optimum: Why A?

indiff. curve slope=budget constr. slope|MRSx,y|=|pxpy||MUxMUy|=|pxpy||−0.5|=|−0.5|

Consumer would exchange at same rate as market

No other combination of (x,y) exists at current prices & income that could increase utility!

The Consumer's Optimum: Two Equivalent Rules

Rule 1

MUxMUy=pxpy

- Easier for solving math problems (slope of each curve)

The Consumer's Optimum: Two Equivalent Rules

Rule 1

MUxMUy=pxpy

- Easier for calculation (slopes)

Rule 2

MUxpx=MUypy

- Easier for intuition (next slide)

The Consumer's Optimum: The Equimarginal Rule I

MUxpx=MUypy=⋯=MUnpn

Equimarginal Rule: consumption is optimized where the marginal utility per dollar spent is equalized across all n possible goods/decisions

You will always choose an option that gives higher marginal utility (e.g. if MUx>MUy)

- But each option has a different cost, so we weight each option by its cost, hence MUxpx

The Consumer's Optimum: The Equimarginal Rule II

MUxpx=MUypy=⋯=MUnpn

- Why is this the optimum?

The Consumer's Optimum: The Equimarginal Rule II

MUxpx=MUypy=⋯=MUnpn

Why is this the optimum? Example: suppose you could get a higher marginal utility per $1 for x than for y (i.e. "more bang for your buck"!)

Not maximizing your utility!

- Spend more on x and less on y!

- This will raise MUx and lower MUy!

Continue until cost-adjusted marginal utilities are equalized

The Consumer's Optimum: The Equimarginal Rule III

Any optimum in economics: no better alternatives exist under current constraints

No possible change in your consumption that would increase your utility

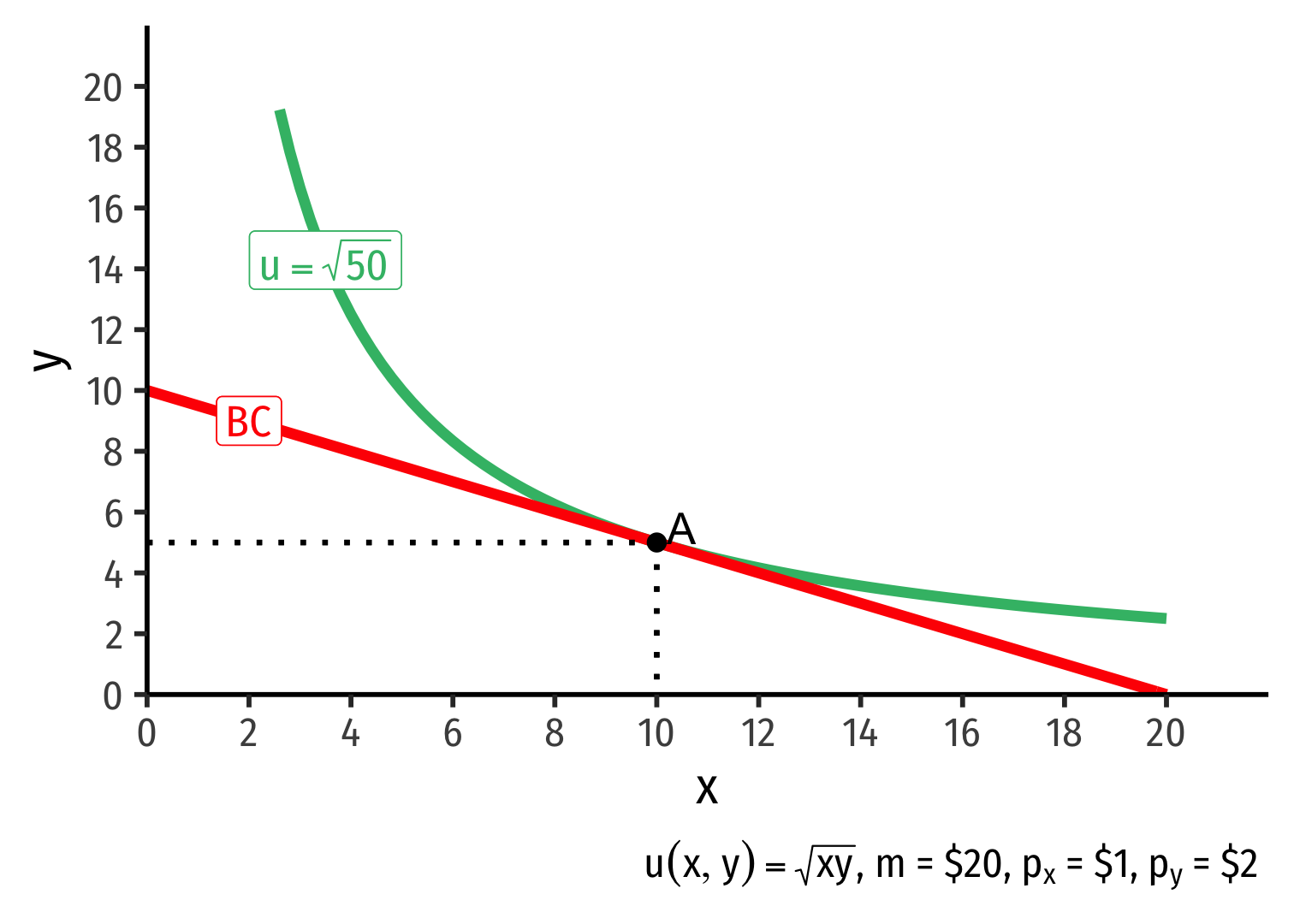

Markets Equalize Everyone's MRS I

Markets make it so everyone faces the same relative prices

- Budget constraint. slope, −pxpy

- Note individuals' incomes, m, are certainly different!

A person's optimal choice ⟹ they make same tradeoff as the market

- Their MRS = relative price ratio

markets equalize everyone's MRS

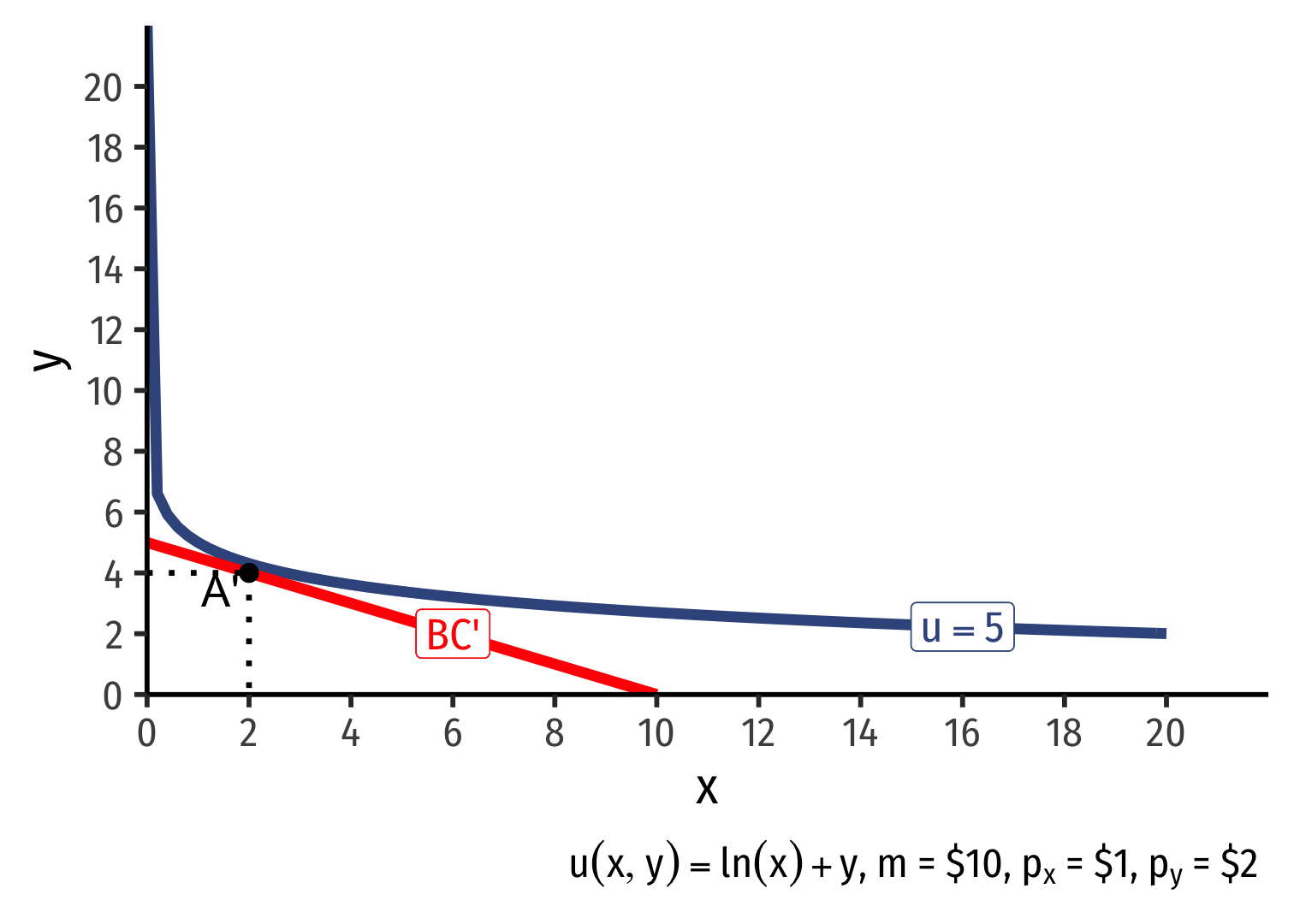

Markets Equalize Everyone's MRS II

Two people will very different income and preferences face the same market prices, and choose optimal consumption (points A and A') at an exchange rate of 0.5Y:1X

Optimization and Equilibrium

If people can learn and change their behavior, they will always switch to a higher-valued option

If a person has no better choices (under current constraints), they are at an optimum

If everyone is at an optimum, the system is in equilibrium

Practice I

Example: You can get utility from consuming bags of Almonds (a) and bunches of Bananas (b), according to the utility function:

u(a,b)=abMUa=bMUb=a

You have an income of $50, the price of Almonds is $10, and the price of Bananas is $2. Put Almonds on the horizontal axis and Bananas on the vertical axis.

- What is your utility-maximizing bundle of Almonds and Bananas?

- How much utility does this provide? [Does the answer to this matter?]

Practice II, Cobb-Douglas!

Example: You can get utility from consuming Burgers (b) and Fries (f), according to the utility function:

u(b,f)=√bfMUb=0.5b−0.5f0.5MUf=0.5b0.5f−0.5

You have an income of $20, the price of Burgers is $5, and the price of Fries is $2. Put Burgers on the horizontal axis and Fries on the vertical axis.

- What is your utility-maximizing bundle of Burgers and Fries?

- How much utility does this provide?