4.5: Sequential Games & Contestable Markets

ECON 306 · Microeconomic Analysis · Spring 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microS20

microS20.classes.ryansafner.com

Game Theory: Some Generalizations

Game Theory: Some Generalizations

There's a lot more to game theory than a one-shot prisoners' dilemma:

one shot vs. repeated game

discrete vs. continuous strategies

perfect vs. incomplete vs. and asymmetric information

simultaneous vs. sequential game

See my game theory course for more (likely taught next in Fall 2021)

Solution Concepts

We use "solution concepts" to allow us to predict an equilibrium of a game

Nash Equilibrium is the primarly solution concept

- Note it has many variants depending on if games are sequential vs. simultaneous, perfect vs. imperfect information, etc.

Solution Concepts: Nash Equilibrium

- Recall, Nash Equilibrium: no players want to change their strategy given what everyone else is playing

- All players are playing a best response to each other

Solution Concepts: Nash Equilibrium

Important about Nash equilibrium:

N.E. ≠ the "best" or optimal outcome

- Recall the Prisoners' Dilemma!

Game may have multiple N.E.

Game may have no N.E. (in "pure" strategies)

Example: Coordination Game

- A Coordination Game

- No dominant strategies

Example: Coordination Game

- Two Nash equilibria: (A,A) and (B,B)

- Either just as good

- Coordination is most important

Example: Coordination Game

- Two general methods to solve for Nash equilibria:

1) Cell-by-Cell Inspection: look in each cell, does either player want to deviate?

- If no: a Nash equilibrium

- If yes: not a Nash equilibrium

Example: Coordination Game

- Two general methods to solve for Nash equilibria:

2) Best-Response Analysis: take the perspective of each player. If the other player plays a particular strategy, what is your strategy(s) that gets you the highest payoff?

- Ties are allowed

- Any cell where both players are playing a best response is a Nash Equilibrium

Example: Coordination Game

Player 1's best responses

- Two general methods to solve for Nash equilibria:

2) Best-Response Analysis: take the perspective of each player. If the other player plays a particular strategy, what is your strategy(s) that gets you the highest payoff?

- Ties are allowed

- Any cell where both players are playing a best response is a Nash Equilibrium

Example: Coordination Game

Player 2's best responses

- Two general methods to solve for Nash equilibria:

2) Best-Response Analysis: take the perspective of each player. If the other player plays a particular strategy, what is your strategy(s) that gets you the highest payoff?

- Ties are allowed

- Any cell where both players are playing a best response is a Nash Equilibrium

Example: Coordination Game

N.E.: each player is playing a best response

- Two general methods to solve for Nash equilibria:

2) Best-Response Analysis: take the perspective of each player. If the other player plays a particular strategy, what is your strategy(s) that gets you the highest payoff?

- Ties are allowed

- Any cell where both players are playing a best response is a Nash Equilibrium

A Change in the Game

Two Nash equilibria again: (A,A) and (B,B)

But here (A,A) ≻ (B,B)!

A Change in the Game

Path Dependence: early choices may affect later ability to choose or switch

Lock-in: the switching cost of moving from one equilibrium to another becomes prohibitive

Suppose we are currently in equilibrium (B,B)

Inefficient lock-in:

- Standard A is superior to B

- But too costly to switch from B to A

Sequential Games

Sequential Games: Extensive Form

We consider an Entry Game, a sequential game played between a potential Entrant and an Incumbent

A sequence of play: Entrant moves first, Incumbent moves second

Note: the magnitude of the payoffs don't really matter, only their relative sizes

- Hence, my simple numbers

Pure Strategies

This game is depicted in "Extensive form" or a game tree

Each player faces at least one "decision node" (solid, colored by player)

- Entrant chooses between Enter or Stay Out at node E.1

- Incumbent chooses between Accommodate or Fight at I.1

- Game ends at any "terminal node" (hollow node), and each player earns payoffs (Entrant, Incumbent)

Pure Strategies

We need to talk more about strategies

Pure strategy: a player's complete plan of action for every possible contingency

- i.e. what a player will choose at every possible decision node

- think like an algorithm:

if we reach node 1, I will play X; if we reach node 2, I will play Y; if ...

- "Mixed strategy": play a strategy with some probability

Solving a Sequential Game

Entrant has 2 pure strategies:

- Stay Out at E.1

- Enter at E.1

Incumbent has 2 pure strategies:

- Accommodate at I.1

- Fight at I.1

Note Incumbent's strategy only comes into play if Entrant plays Enter and the game reaches node I.1

Solving a Sequential Game: Backward Induction

Backward induction: to determine the outcome of the game, start with the last-mover (i.e. decision nodes just before terminal nodes)

What is that mover's best choice to maximize their payoff?

Solving a Sequential Game: Backward Induction

- We start at I.1 where Incumbent can:

- Accommodate to earn 1

- Fight to earn 0

Solving a Sequential Game: Backward Induction

- Incumbent will Accommodate if game reaches I.1

Solving a Sequential Game: Backward Induction

Incumbent will Accommodate if game reaches I.1

Given this, what will Entrant do at E.1?

- Stay Out to earn 1

- Enter, knowing Incumbent will Accommodate, and so will earn 2

Solving a Sequential Game: Backward Induction

Entrant will Enter at E.1

Continue until we've reached the initial node (beginning)

We have the outcome:

(Enter, Accommodate)

- Some textbooks call this a "rollback equilibrium"

- more technical name: subgame perfect Nash equilibrium

Contestable Markets

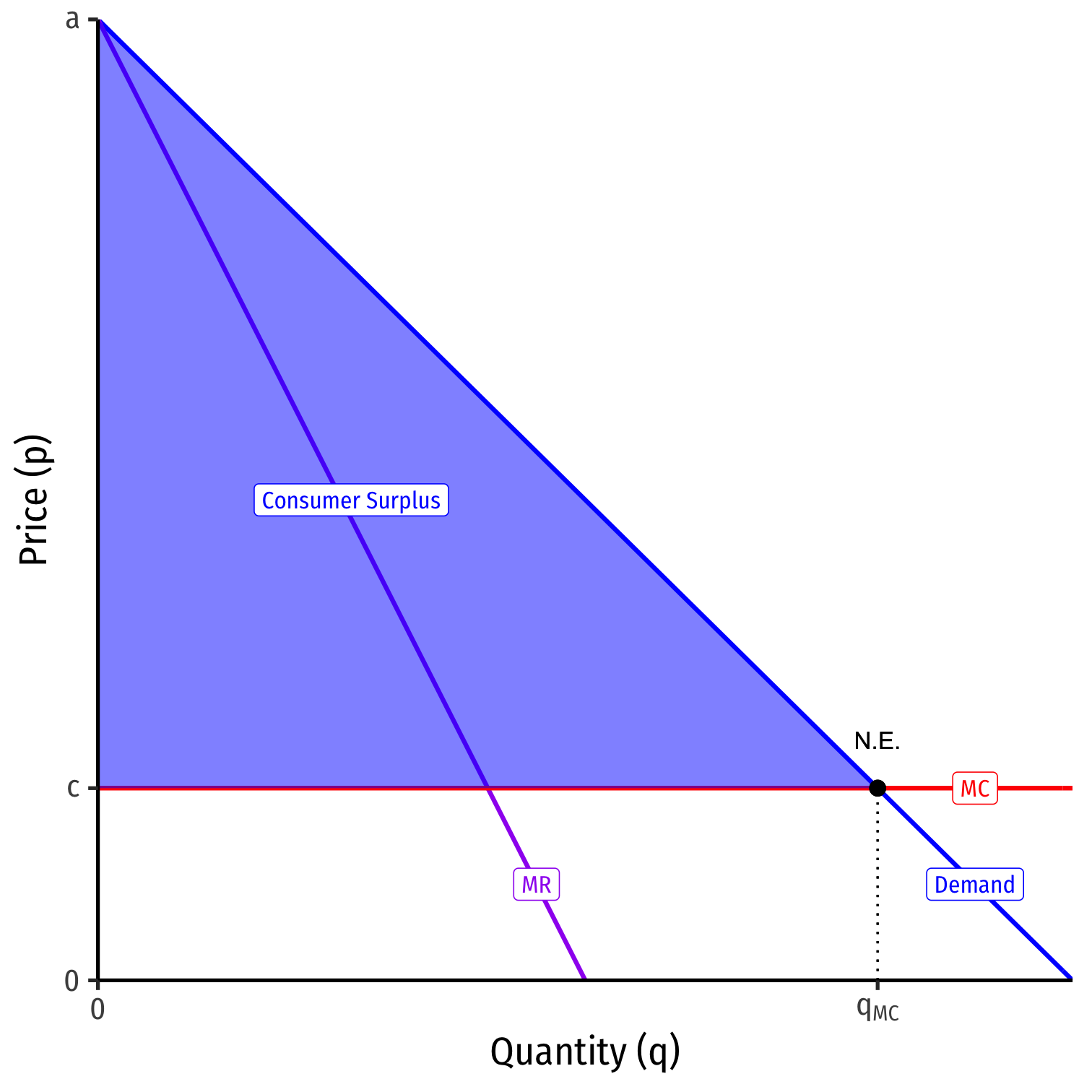

Is Monopoly a Nash Equilibrium?

Now that we understand Nash equilibrium...

Are outcomes of other market structures Nash equilibria?

Is Monopoly a Nash Equilibrium?

Now that we understand Nash equilibrium...

Are outcomes of other market structures Nash equilibria?

Perfect competition: no firm wants to raise or lower price given the market price ✓

Is Monopoly a Nash Equilibrium?

Monopolist maximizes π by setting q∗: MR=MC and p∗=Demand(q∗)

This is an equilibrium, but is it the only equilibrium?

We've assumed just a single player in the model

What about potential competition?

Contestable Markets I

- Model the market as an entry game, with two players:

Incumbent which sets its price pI

Entrant decides to stay out or enter the market, setting its price pE

- Price competition between 2 firms with similar products ⟹ consumers buy only from firm with lower price

Contestable Markets II

Suppose firms have costs of C(q)=cqMC(q)=c

If Incumbent sets pI>c, then Entrant would enter and set pE=pI−ϵ (for arbitrary ϵ>0)

Contestable Markets II

Suppose firms have costs of C(q)=cqMC(q)=c

If Incumbent sets pI>c, then Entrant would enter and set pE=pI−ϵ (for arbitrary ϵ>0)

- Incumbent would forsee this, and try to price lower than pE

- undercutting continues until...

Contestable Markets II

Nash Equilibrium: incumbent sets pI=c, no entry

A market with a single firm, but the competitive outcome!

- p∗=MC, π=0

- competitive q∗

- max Consumer Surplus, no DWL

Contestable Markets II

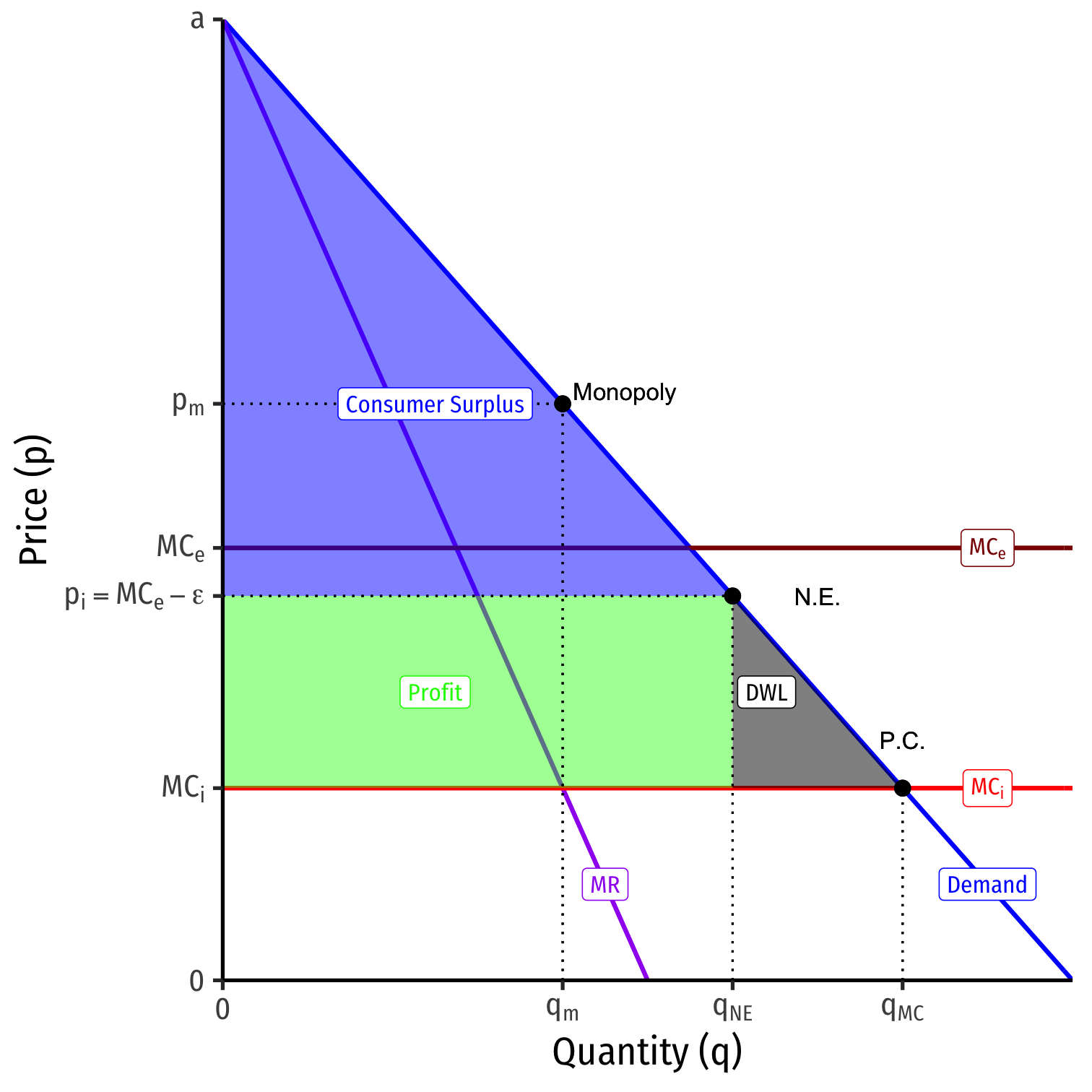

- What if the entrant has higher costs than the incumbent: cE>cI?

Contestable Markets II

What if the entrant has higher costs than the incumbent: cE>cI?

Nash equilibrium: incumbent sets pI=pE−ϵ

- arbitrary ϵ>0

Entrant stays out

One firm, but not a worst case monopoly

Contestable Markets II

What if the entrant has higher costs than the incumbent: cE>cI?

Nash equilibrium: incumbent sets pI=pE−ϵ

- arbitrary ϵ>0

Entrant stays out

One firm, but not a worst case monopoly

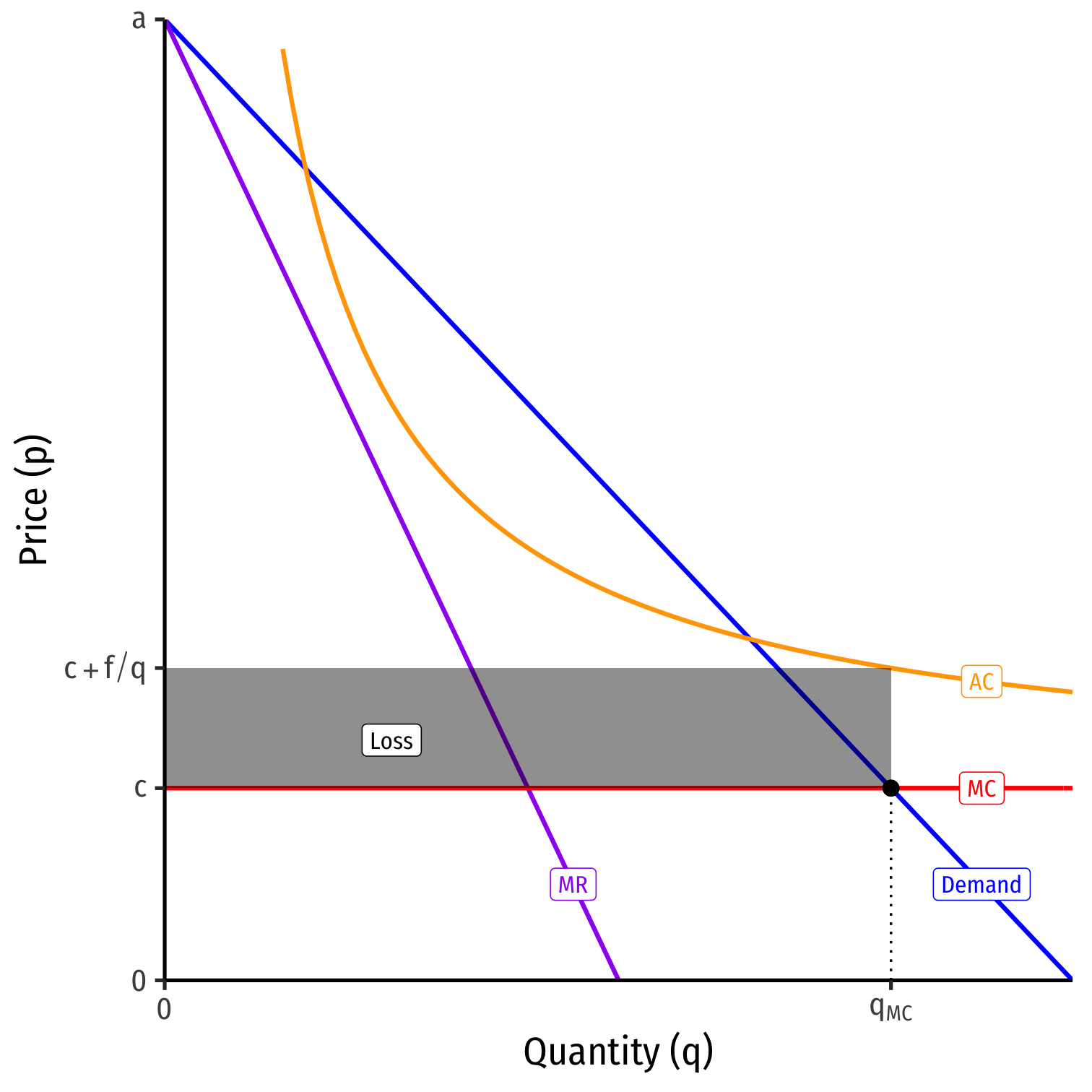

Contestable Markets III

- What if there are fixed costs, f?

C(q)=cq+fMC(q)=cAC(q)=c+fq

- With high enough f, Economies of scale may prevent marginal cost pricing from a being profitable Nash Equilibrium

πp=MC=−fq<0

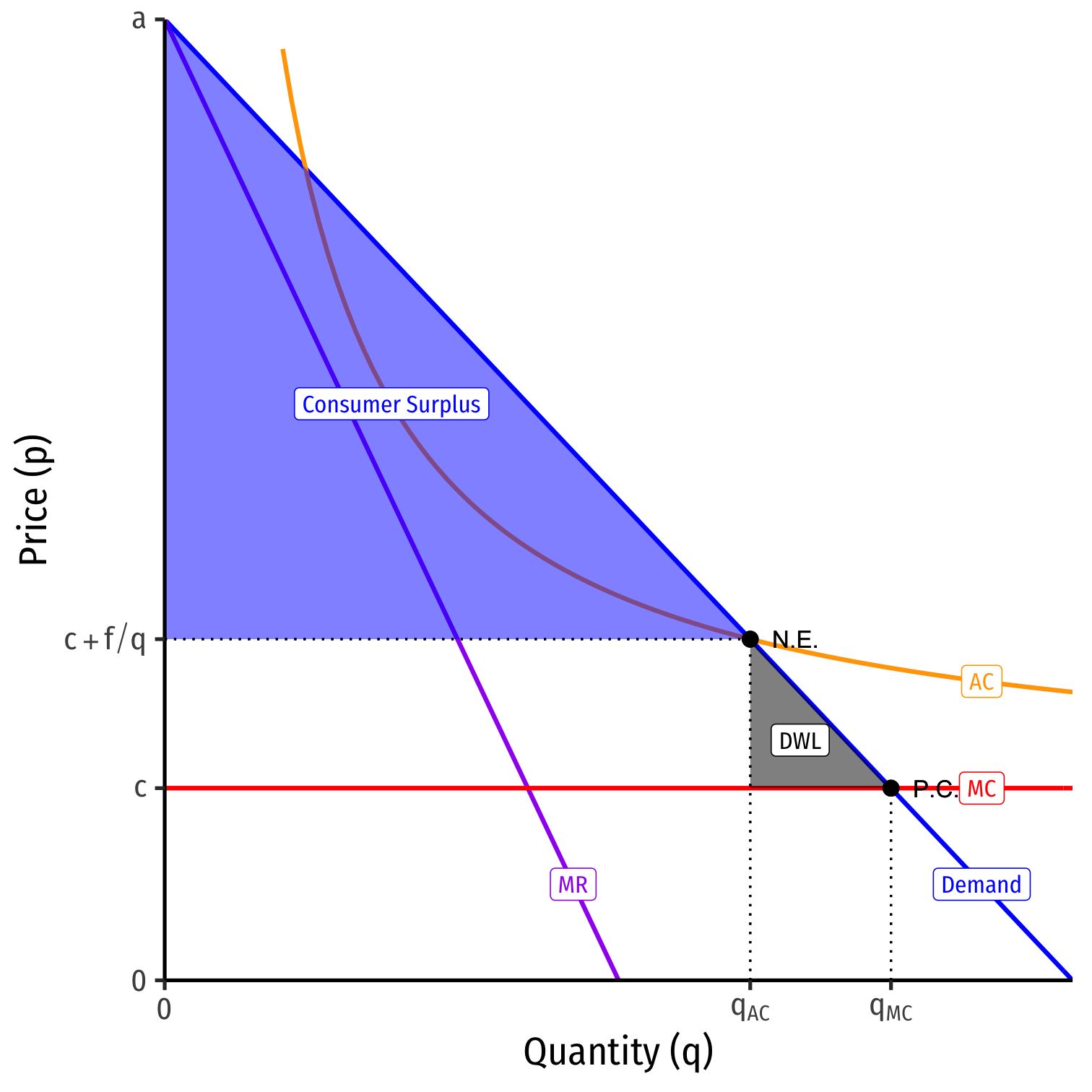

Contestable Markets IV

Nash equilibrium: Incumbent prices at pI=AC earns π=0

Entrant stays out

Again, single firm, but not a monopoly

- no profits

- not allocatively efficient, p>MC, some DWL

What About Sunk Costs? I

Fixed costs ⟹ do not vary with output

If firm exits, could sell these assets (e.g. machines, real estate) to recover costs

- Thus, "hit-and-run" competition remains potentially profitable

- Maintains credible threat against incumbent acting as a monopolist

What About Sunk Costs? I

But what if assets are not sellable and costs not recoverable - i.e. sunk costs?

e.g. research and development, spending to build brand equity, advertising, worker-training for industry-specific skills, etc

What About Sunk Costs? II

These are bygones to the Incumbent, who has already committed to producing

But are new costs and risk to Entrant, lowering expected profits

In effect, sunk costs raise cE>cI, and return us back to our second example

Nash equilibrium: Incumbent deters entry with pI=pE−ϵ

- Inefficient, p>AC, but again not monopoly

Contestable Markets: Recap

Markets are contestable if:

- There are no barriers to entry or exit

- Firms have similar technologies (i.e. similar cost structure)

- There are no sunk costs

Economies of scale need not be inconsistent with competitive markets (as is assumed) if they are contestable

Generalizes "prefect competition" model in more realistic way, also game-theoretic

Contestable Markets: Summary

William Baumol

(1922--2017)

"This means that...an incumbent, even if he can threaten retaliation after entry, dare not offer profit-making opportunities to potential entrants because an entering firm can hit and run, gathering in the available profits and departing when the going gets rough."

Baumol, William, J, 1982, "Contestable Markets: An Uprising in the Theory of Industry Structure," American Economic Review, 72(1): 1-15

Implications for Competition

Regulation & antitrust (once) focus(ed) on number of firms

- "Count the number of firms, if it's 1, it's a monopoly!"

Perfect competition as "gold standard", only market arrangement that is socially efficient:

- Allocatively efficient: p=MC, DWL=0

- Productively efficient: p=ACmin

Implications for Competition

But number of firms is endogenous and can evolve over time!

- Function of how firms mutually interact strategically

A more dynamic situation: firms respond over time

Implications for Competition

Perfect competition not the only socially efficient market-structure

- Small number of firms (including 1) may be efficient if they are contestable

Regulation and antitrust should consider whether a market is contestable, not just the number of firms

- Free entry

- No sunk costs

Implications for Competition

Firms engaging in egregious monopolistic behavior (↓q, ↑p, p>MC, π>0) largely persist because of barriers to entry

- Attempts to market uncontestable

Business activities or political dealings with the goal to raise cE>cI

- ower your own costs, or raise your rivals'!

Monopoly Or Contestable Market?

Contestable Markets

"Of far greater concern to Microsoft is the competition from new and emerging technologies, some of which are currently visible and others of which certainly are not. This array of known, emerging, and wholly unknown competitors places enormous pressure on Microsoft to price competitively and innovate aggressively." (Schmalensee 1999)

Contestable Markets

So What's the Point of the Models?

In perfect competition (model):

- price-taking firms set price equal to marginal cost

- long run economic profits are zero

- allocative efficiency: consumer and producer surplus maximized

This is a tendency only because of free entry and exit

So What's the Point of the Models?

Don't judge real markets by their similarity to the perfect competition model

Judge them more on their level of contestability, ease of potential entry

So What's the Point of the Models?

"...In that Empire, the Art of Cartography attained such Perfection that the map of a single Province occupied the entirety of a City, and the map of the Empire, the entirety of a Province. In time, those Unconscionable Maps no longer satisfied, and the Cartographers Guilds struck a Map of the Empire whose size was that of the Empire, and which coincided point for point with it. The following Generations, who were not so fond of the Study of Cartography as their Forebears had been, saw that that vast Map was Useless..."

Jorge Luis Borges, 1658, On Exactitude in Science